Your contacts

1.—Swiss tobacco product law

1.1—(Current) Qualifying features in Swiss tobacco law

Due to the (still) existing peculiarities within Swiss tobacco law, the requirements for tobacco products are derived from food law, specifically from the Federal Act on Foodstuffs and Utility Articles (Foodstuffs Act, oFSA) of 9 October 1992. Accordingly, tobacco products form a sub-segment of the concept of food and were or are subsumed under the old legal concept of so-called luxury foodstuffs, which includes tobacco and alcoholic beverages (cf. Art. 3 para. 3 oFSA).

Based on the oFSA, the Ordinance on Tobacco Products and Smoking Products with Tobacco Substitutes (Tobacco Ordinance, TobO) came into force on 27 October 2004. The scope of application of the TobO extends exclusively to tobacco products and smoking products containing tobacco substitutes (cf. Art. 1 para. 1 TobO). A product qualifies as a tobacco product if it consists wholly or partly of tobacco and is intended in particular for smoking (cigars, cigarettes and similar products as well as cut and roll-your-own tobacco), snuffing, sucking or chewing, while substances intended for smoking with the exception of tobacco are counted as tobacco substitutes. In other words, it is clear from the conception of the TobO that ‘more modern’ products such as chemical snus products (e.g. nicotine pouches) or the electronic cigarettes of interest here (so-called e-cigarettes) are excluded from the current scope of application of the TobO and are therefore not subject to Swiss tobacco regulation – despite the clear analogy to traditional tobacco products.

As it is mandatory under Swiss product law for all products to be subject to a product class – from a regulatory perspective – e-cigarettes are currently considered to be so-called utility articles for human contact under the (new) Federal Act on Foodstuffs and Utility Articles (Foodstuffs Act, FSA) of 20 June 2014. According to Art. 5 lit. b FSA, these are articles, substances and preparations which, according to their intended purpose, come into external contact with the body, teeth or mucous membranes. According to the Foodstuffs and Utility Articles Ordinance (FSO) of 16 December 2016, which forms part of the FSA, no substance that imparts pharmacological effects to the end product, such as nicotine or disinfectants, may be added to such products (see Art. 61 para. 2 FSO). This regulatory circumstance is particularly troublesome in the area of e-cigarettes, as strictly speaking – at least based on Swiss consumer goods legislation – no market for e-cigarettes can exist in Switzerland. However, due to the applicable Cassis de Dijon principle under the Federal Act on Technical Barriers to Trade (TBT) of 6 October 1995, nicotine-containing e-cigarettes – despite the nicotine ban in Art. 61 para. 2 FSO) – may nevertheless be marketed in Switzerland under certain conditions if the products are legally marketed in the EU or EEA and can therefore be referred to a reference country from the perspective of the Swiss market (see Art. 16a para. 1 TBT).

As a result, e-cigarettes could and can still be legally sold in Switzerland, although such products are not subject to the stricter tobacco regulations (including labelling and advertising restrictions). In the past, this in turn led to the unacceptable consequences that e-cigarettes could also be sold to young people from a legal perspective – including without further warnings and without an age limit.

1.2—Introduction of the Tobacco Products Act and entry into force

In October 2021, the Swiss parliament passed the new Federal Act on Tobacco Products and Electronic Cigarettes (Tobacco Products Act, TPA). The Tobacco Products Act adopted in 2021 was based on the second draft bill prepared by the Federal Council, after Parliament rejected a first draft in 2016. The Tobacco Products Act has since been set to enter into force in the second half of 2024; the Federal Council is currently working on the final version of the Ordinance on Tobacco Products and Electronic Cigarettes (Tobacco Products Ordinance, TPO).

Parallel to the legislative process, the popular initiative ‘Yes to protecting children and young people from tobacco products’ was launched and voted on by the Swiss electorate on 13 February 2022. The initiative provided for tobacco advertising to be banned as far as possible in all information channels that young people can realistically make use of, i.e. recently also in newspapers and thus media that do not have to be specifically aimed at young people and minors (as previously required under the Tobacco Ordinance), but which experience has shown are viewed by a wide audience. As a result of the adoption of the popular initiative, the new TPA must be revised for the first time before it comes into force; accordingly, the advertising regulations provided for under the TPA must be tightened within a three-year period, starting on 13 February 2022 – compared to the existing draft law.

1.3—Changes to the content of the Tobacco Products Act in relation to e-cigarettes

The purpose of the new TPA, which is expected to come into force in 2024, is to generally protect people from the harmful effects of consuming tobacco products and using e-cigarettes. The scope of the new Tobacco Act thus goes well beyond that of the old Tobacco Ordinance and the original problem of classifying e-cigarettes has been conclusively resolved. In other words, the new Swiss tobacco law will in future also include regulatory requirements for e-cigarettes (vapes), which means that these products will no longer fall within the scope of Swiss food law, as was previously the case.

The new TPA also contains a separate definition of an electronic cigarette. A device that is used without tobacco and with which the emissions of a liquid heated by means of added energy can be inhaled with or without nicotine, as well as refill material for this device, qualifies as such (cf. Art. 3 lit. f TPA).

Due to the inclusion of electronic cigarettes under the TPA, Swiss tobacco law will in future contain numerous (new) provisions that relate specifically to e-cigarettes (vapes). The most important changes in this context are as follows:

- Containers of nicotine-containing liquids may only be supplied to consumers in the following maximum volumes: (a.) 10 ml for refill material; (b.) 2 ml for electronic disposable cigarettes and disposable cartridges (cf. Art. 9 TPA);

- All packaging of e-cigarettes must contain the following mandatory information when supplied to consumers: (i.) a product description; (ii.) a company name; (iii.) the country of production; and (iv.) warnings (cf. Art. 10 para. 1 TPA);

- The new (mandatory) warning for nicotine-containing e-cigarettes reads: ‘This product can damage your health and is highly addictive’ (Art. 14 para. 1 lit. d TPA);

- The new (mandatory) warning for nicotine-free e-cigarettes reads: ‘This product can harm your health’ (Art. 14 para. 1 lit. e TPA);

- For refill material, containers with nicotine-containing liquids must (i.) be child-resistant; (ii.) be unbreakable; and (iii.) have a leak-proof mechanism for refilling (Art. 16 TPA);

- All packaging of e-cigarettes must contain instructions for use and information that the product is not recommended for use by minors or non-smokers (Art. 17 para. 1 TPA);

- Compliance with advertising restrictions, although – as mentioned above – these are being revised as a result of the above-mentioned popular initiative (see Art. 18 TPA);

- The supply of e-cigarettes to minors, i.e. persons under the age of 18, will be prohibited in future (Art. 23 TPA); and

- Mandatory notification of e-cigarettes to the Federal Office of Public Health (FOPH) when they are manufactured or imported.

2.—Swiss tobacco tax law

2.1—Currently applicable tobacco tax law

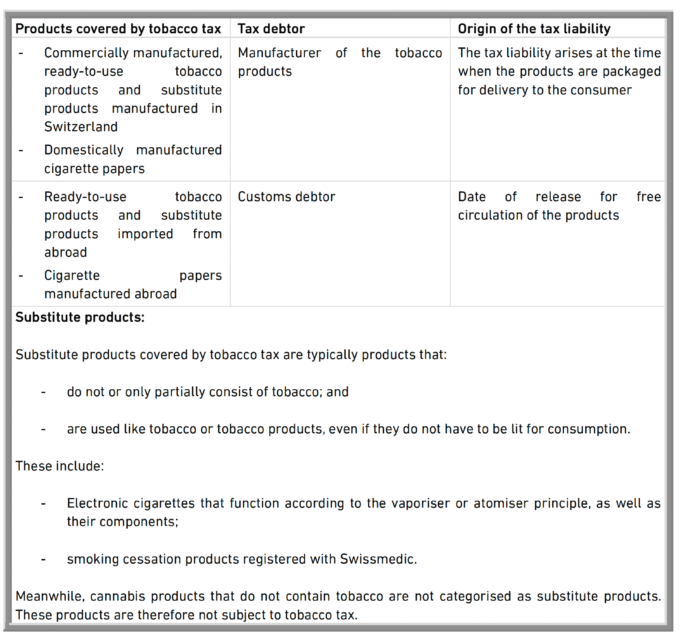

In Switzerland, a corresponding tobacco tax is levied on the consumption of tobacco products. The Federal Office for Customs and Border Security (FOCBS) is responsible for collecting the tax. The following overview shows which products are currently subject to tobacco tax under the existing Tobacco Tax Act (TTA)1, who is liable to pay the tax and when the tax liability arises in each case:

The tax rates are set according to the average weight and the retail price. In addition to the tobacco tax, tobacco manufacturers must pay CHF 0.026 per packet of cigarettes into the Tobacco Prevention Fund and into the SOTA Fund2 (purchasing cooperative for domestic tobacco), which is intended to promote domestic tobacco cultivation.

Tobacco tax is considered a special form of excise duty and has a dual character: on the one hand, it fulfils a fiscal purpose in that the revenue from tobacco tax, together with that from tobacco duties and the taxation of spirits, is used to finance the federal share of AHV/IV. On the other hand, it also has the characteristics of an incentive tax, as it is intended to influence the consumption of tobacco products. Recent developments in the taxation of e-cigarettes (vapes) have brought the latter characteristics more to the fore.

2.2—Vapes will be subject to tobacco tax from 2025 at the latest

However, the TTA will now be amended to the effect that vapes and e-cigarettes will now also be covered by tobacco tax under the category of substitute products. On 26 October 2022, the Federal Council adopted the dispatch on the corresponding amendment to the Federal Act on Tobacco Taxation3. The introduction of the changes was originally planned for January 2024, but has been delayed. According to information received from the FOCA, the amendment to the TTA with regard to the taxation of e-cigarettes is currently not expected to be introduced until autumn of this year at the earliest (not before 1 October 2024) or January 2025. The date will be set by the Federal Office of Public Health.

Specifically, e-cigarettes with nicotine-containing or nicotine-free liquids will be subject to tobacco tax in future. It is planned that products in disposable e-cigarettes will be taxed at a higher rate than products for reusable e-cigarettes. The taxable person and the origin of the tax liability are based on the guidelines listed in the previous chapter.

The proposed tax rate for these products is to be structured as follows:

- For nicotine-containing products that can be consumed using refillable electronic cigarettes: CHF 0.20 per millilitre of liquid.

- For single-use e-cigarettes, however, the proposed tax rate is CHF 1.00 per millilitre of liquid, regardless of whether they contain nicotine or not.

The tax rates for reusable e-cigarettes were deliberately set at a low level. In line with the role of an incentive tax, this is not intended to prevent e-cigarettes from being used as a means of quitting smoking. On the other hand, the higher taxation of disposable e-cigarettes is intended to have an impact, particularly in terms of protecting young people.

The tax rates for reusable e-cigarettes were deliberately set at a low level. In line with the role of an incentive tax, this is not intended to prevent e-cigarettes from being used as a means of quitting smoking. On the other hand, the higher taxation of disposable e-cigarettes is intended to have an impact, particularly in terms of protecting young people.

The tax rates for reusable e-cigarettes were deliberately set at a low level. In line with the role of an incentive tax, this is not intended to prevent e-cigarettes from being used as a means of quitting smoking. On the other hand, the higher taxation of disposable e-cigarettes is intended to have an impact, particularly in terms of protecting young people.

The tax rates for reusable e-cigarettes were deliberately set at a low level. In line with the role of an incentive tax, this is not intended to prevent e-cigarettes from being used as a means of quitting smoking. On the other hand, the higher taxation of disposable e-cigarettes is intended to have an impact, particularly in terms of protecting young people.

1 Tobacco tax is regulated in the Federal Act on Tobacco Taxation (TTA) and the corresponding Ordinance (TTO).

2 See also: Ordinance on Producer and Manufacturer Prices for Domestic Tobacco: SR 916.116.4 – SR 916.116.4 – Verordnung vom 18. Dezember 1996 … | Fedlex (admin.ch)

3 Further information and the draft bill can be found at the following link: https://www.bag.admin.ch/bag/de/home/strategie-und-politik/politische-auftraege-und-aktionsplaene/politische-auftraege-zur-tabakpraevention/tabakpolitik-schweiz/tabaksteuer.html#:~:text=Derzeit%20unterliegen%20elektronische%20Zigaretten%20nicht%20der%20Tabaksteuer. Dispatch: BBl 2022 2752 – Dispatch on the amendment of the Tobacco… | Fedlex (admin.ch)